PAG-IBIG SHORT-TERM LOAN - A STEP-BY-STEP GUIDE

The Pag-IBIG Fund Multi-Purpose Loan or MPL is a cash loan designed to help our members with any immediate financial need.

A member can borrow up to 80% of their Pag-IBIG Regular Savings, and can be processed in as fast as 2 days!

For more information, click this link. Pag-ibig Short-Term Loan (STL)

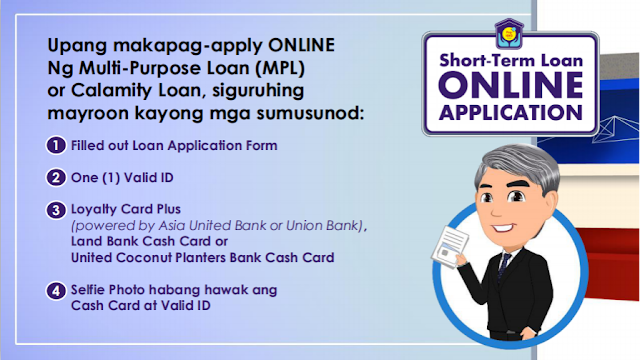

- Filled out Loan Application Form

- One (1) Valid ID

- Loyalty Card Plus (powered by Asia United Bank or Union Bank), Land Bank Cash Card or United Coconut Planters Bank Cash Card

- Selfie photo while holding your cash card and valid ID

Go to Pag-ibig Fund Website @ www.pagibigfund.gov.ph and click Virtual Pag-ibig on the menu bar.

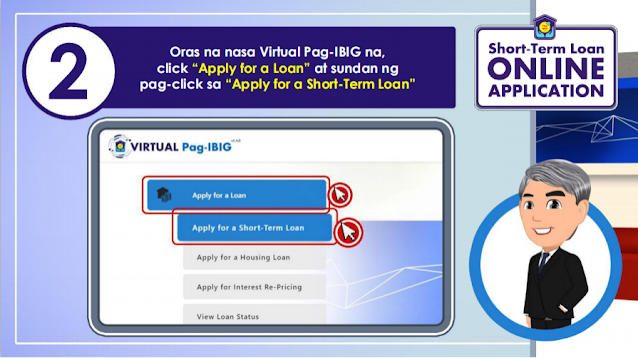

STEP 2

Once you are on the Virtual Pag-ibig page click apply for a loan and then click apply for a short term-loan.

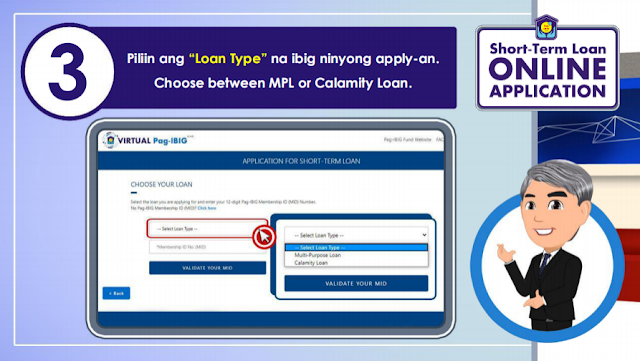

STEP 3

Select the loan type that you want to apply. Choose between Multi-purpose Loan (MPL) or Calamity Loan.

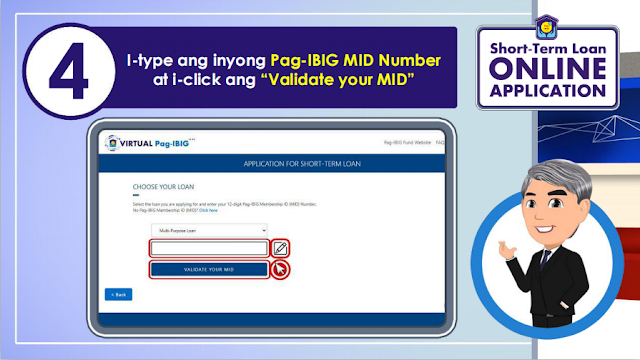

STEP 4

Type your Pag-ibig MID number and then click validate your MID.

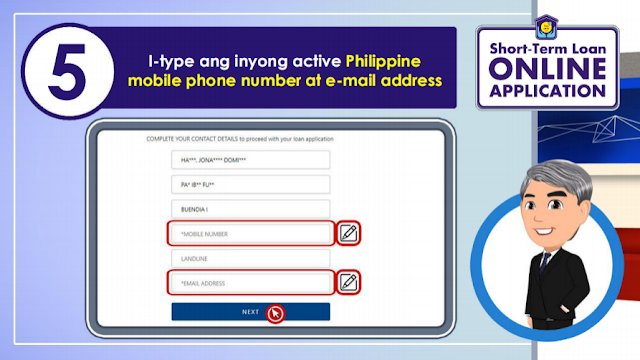

STEP 5

Type your active Philippine mobile phone number and e-mail address.

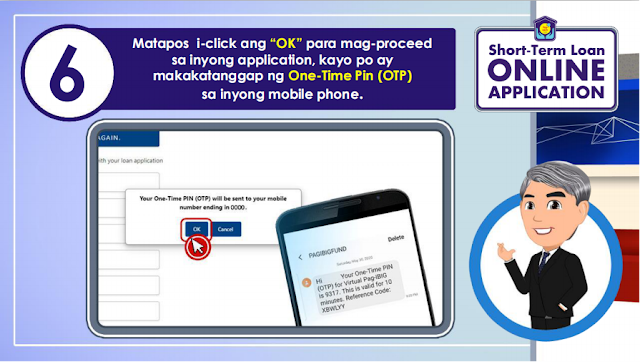

STEP 6

Click OK to proceed to your application. You will receive a One-Time Pin (OTP) in your mobile number.

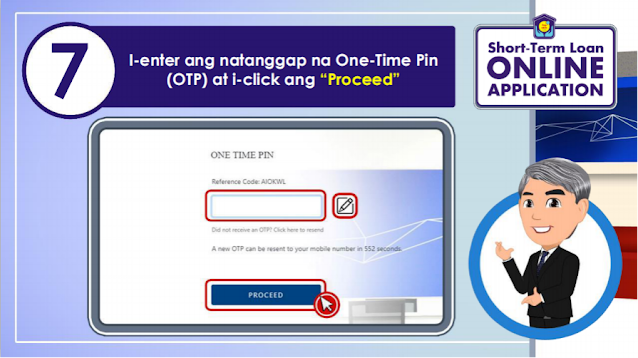

STEP 7

Enter the One-Time Pin (OTP) that you received and click proceed.

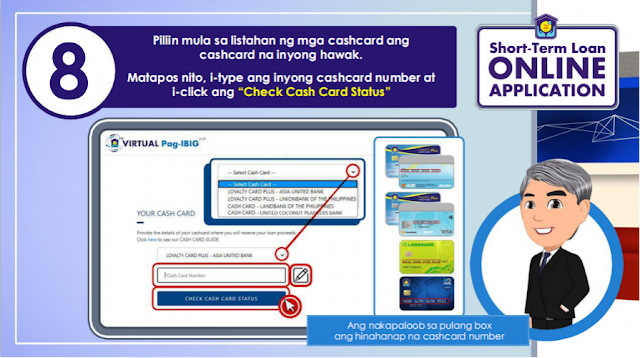

STEP 8

Choose from the list of cash cards the cash card that your are going to use. After this, type your cash card number and click "check cash card status".

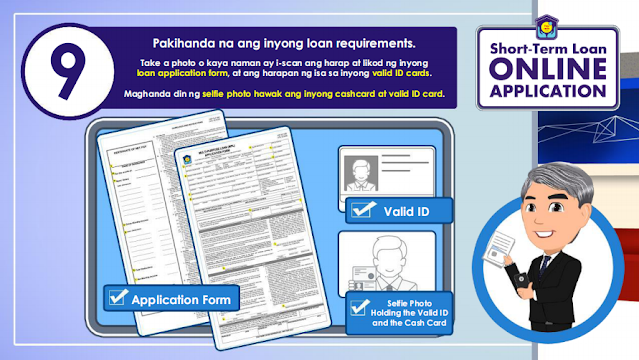

STEP 9

Get your loan requirements ready. Take a photo or scan the front and back of your loan application form and the front of one of your valid ID cards. Also, prepare a selfie photo while holding your cash card and valid ID card.

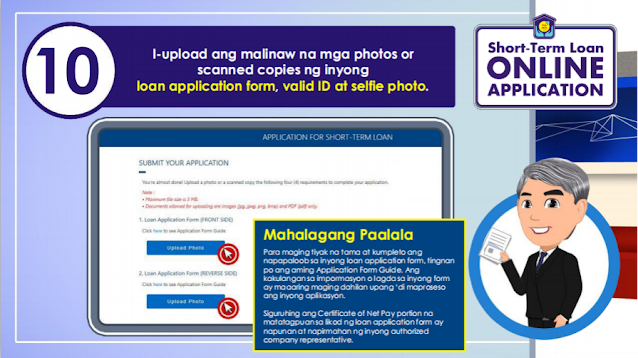

STEP 10

Upload your clear photos or scanned copies of your application form, valid ID and selfie photo.

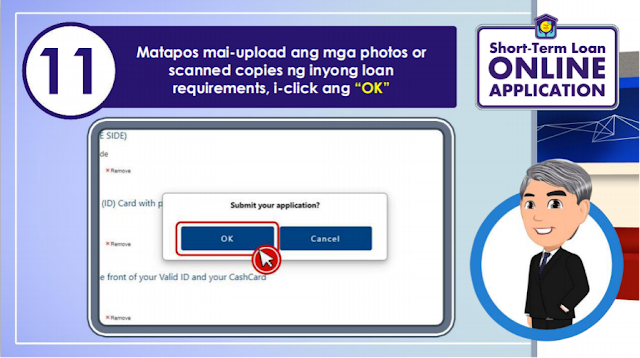

STEP 11

After uploading your photos or scanned copies of your loan requirements, click OK.

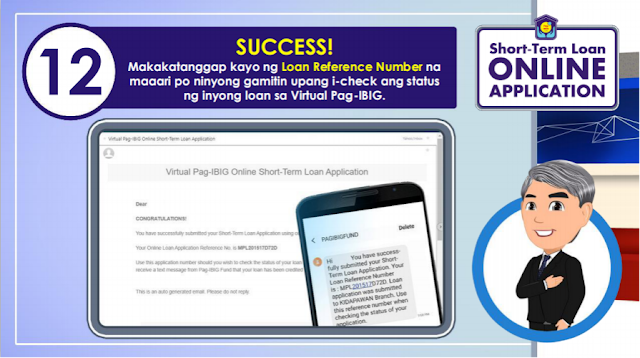

STEP 12

SUCCESS! You will receive Loan Reference Number that you can use to check the status of your loan on Virtual Pag-ibig.

Thank you for visiting our site. Should you have questions, feel free to post them on the comment section or you can use the Contact Us form.

Should you want to apply for a loan to another lending institution, click the following links: